Are you ready for Payday Filing?

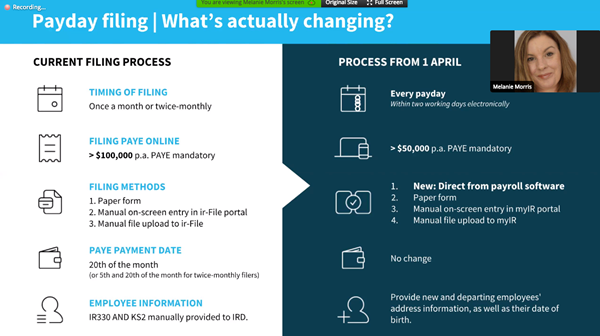

From the 1 April 2019, new payday filing requirements from Inland Revenue mean that every time you pay employees, you’ll also need to file employment information. With payday filing in Xero, you’ll be able to file your employment information to Inland Revenue straight from Xero Payroll, so it only takes a few clicks to complete.

Payday Filing. Xero is ready, are you?

1/. Ensure your employee details are correct - Name, Address and Date of Birth.

2/. Ensure you have Payroll access in your myIR account.

3/. Thats it if you are already using Xero Payroll!!

Already using Xero Payroll?

Good news: there won’t be a big change to how you currently process your pay run. Filing will be simpler and you won’t need any software updates.

The current process of manually uploading your files to myIR will no longer be required. Instead you’ll be able to file your pay run and employee information straight from Xero Payroll after each posted pay run.

Payday Filing Timeline

28 February

- Start using the Payroll Returns account in the My Business section of myIR, to file your EMS & EDF. March returns will need to be filed this way.

11 March 2019

- The ir-File service is myIR, which you currently use to file EMS & EDF will be discontinued on 11 March. After this date, you must file employment information c=via the My Business section of myIR, if you are filing manually.

18 March 2019

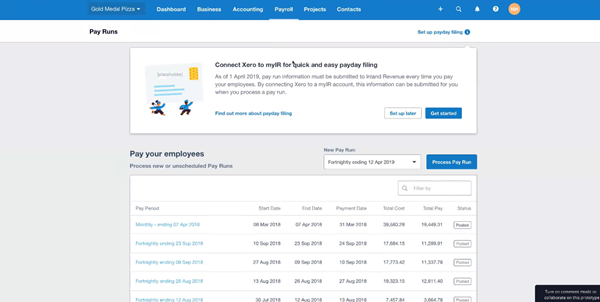

- Establish your connection: Connect Xero to myIR for quick & easy payday filing.

- Once connection is established, payday filing from Xero will automatically switch over for payments made after 1 April 2019.

Start Payday Filing April 2019

- Payday Filing from Xero will start at the beginning of April, after you opt-in during March

What will it look like in Xero?

If you need any help or have any questions. Contact us!

Contact us today

Interested to learn how we can simplify and improve your business accounts and financial performance? Contact us directly, or send us a message using the form below: